Beginning with Private Healthcare for Entrepreneurs: What to Know Before You Buy, the narrative unfolds in a compelling and distinctive manner, drawing readers into a story that promises to be both engaging and uniquely memorable.

Entrepreneurs often face unique challenges when it comes to healthcare options. Understanding the ins and outs of private healthcare before making a decision is crucial for their well-being and business success.

Introduction to Private Healthcare for Entrepreneurs

Private healthcare for entrepreneurs refers to medical services provided by private healthcare facilities that cater specifically to the needs of business owners and self-employed individuals. These services often come at a premium cost but offer various benefits tailored to the unique lifestyle and demands of entrepreneurs.Opting for private healthcare as an entrepreneur can provide numerous advantages.

Firstly, it offers expedited access to healthcare services, allowing entrepreneurs to receive prompt medical attention without long waiting times commonly associated with public healthcare systems. This quick access to specialists and treatments can be crucial for busy entrepreneurs who need to prioritize their health while managing their businesses.Moreover, private healthcare often offers a more personalized and comprehensive approach to healthcare management.

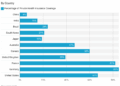

Entrepreneurs can benefit from tailored wellness programs, preventive care initiatives, and dedicated healthcare professionals who understand the specific needs and challenges faced by individuals running their own businesses.Statistics show a rising trend of entrepreneurs choosing private healthcare options over public alternatives.

According to recent data, a growing number of self-employed individuals and business owners are investing in private health insurance plans to ensure they have access to high-quality healthcare services when needed. This shift reflects the increasing importance placed on health and well-being in the entrepreneurial community, highlighting the value placed on efficient and personalized healthcare solutions.

Benefits of Private Healthcare for Entrepreneurs

- Expedited access to healthcare services

- Personalized and comprehensive healthcare management

- Increased focus on wellness programs and preventive care

- Dedicated healthcare professionals familiar with the needs of entrepreneurs

Considerations Before Purchasing Private Healthcare

When considering purchasing private healthcare as an entrepreneur, there are several key factors to keep in mind. It's important to compare the cost of private healthcare to traditional health insurance plans, as well as explore the flexibility and customization options available with private healthcare plans.

Cost Comparison

- Private healthcare plans may have higher premiums compared to traditional health insurance plans.

- However, private healthcare plans often offer more comprehensive coverage and faster access to specialized care.

- Consider your budget and healthcare needs to determine if the extra cost of private healthcare is worth it for you as an entrepreneur.

Flexibility and Customization

- Private healthcare plans typically offer more flexibility in choosing healthcare providers and treatment options.

- You may have the ability to customize your plan to include specific benefits that are important to you, such as alternative therapies or wellness programs.

- Take the time to review the customization options available with different private healthcare plans to find one that best suits your needs as an entrepreneur.

Coverage Options and Limitations

Private healthcare plans offer various coverage options tailored to the needs of entrepreneurs. It is essential to understand the types of coverage available and the limitations or exclusions that may apply when selecting a plan.

Types of Coverage Options

- Basic Coverage: This typically includes essential services such as doctor's visits, preventive care, and some diagnostic tests.

- Comprehensive Coverage: Offers a wider range of services, including specialist consultations, hospital stays, surgeries, and prescription medications.

- Add-Ons or Riders: Additional coverage options that can be purchased to supplement the primary plan, such as dental or vision care.

Limitations and Exclusions

- Pre-Existing Conditions: Some plans may exclude coverage for pre-existing medical conditions that were present before enrolling in the plan.

- Experimental Treatments: Certain innovative or experimental treatments may not be covered by private healthcare plans.

- Cosmetic Procedures: Procedures deemed cosmetic or elective, such as plastic surgery, may not be covered under standard plans.

Specific Services Coverage

- Emergency Room Visits: Most plans cover emergency room visits, but the extent of coverage may vary.

- Mental Health Services: Coverage for mental health services, including therapy and counseling, may be limited in some plans.

- Alternative Medicine: Treatments like acupuncture or chiropractic care may not be covered unless specified in the plan.

Access to Healthcare Providers

Access to healthcare providers is a crucial aspect to consider when choosing a private healthcare plan as an entrepreneur. The network coverage and provider options can greatly impact the quality and timeliness of the healthcare services you receive. Let's explore the importance of network coverage, compare accessibility between private and public healthcare, and provide tips for ensuring you have access to the healthcare providers you need.

Network Coverage and Provider Options

- Private healthcare plans often have a network of healthcare providers such as doctors, specialists, hospitals, and clinics that are included in the plan. It is essential to choose a plan with a wide network to ensure you have access to a variety of providers.

- Having a diverse network of providers gives you the flexibility to choose the healthcare professionals that best suit your needs, whether it's a primary care physician, a specialist, or a specific hospital for treatments or procedures.

- Compare the network coverage of different private healthcare plans to ensure that your preferred providers are included. Some plans may offer access to renowned specialists or top-tier healthcare facilities, which can be beneficial for entrepreneurs with specific healthcare needs.

Accessibility in Private vs Public Healthcare

- In private healthcare, access to specialists and healthcare facilities is often quicker and more convenient compared to public healthcare. Private providers may offer shorter wait times for appointments, faster diagnostic tests, and expedited access to treatments.

- Public healthcare, on the other hand, may have longer wait times for specialist consultations or procedures due to high patient volumes and limited resources. Entrepreneurs seeking prompt and efficient healthcare services may find private healthcare more suitable for their needs.

- Consider the trade-offs between private and public healthcare accessibility based on your healthcare preferences, urgency of care, and financial capabilities. Private healthcare plans offer faster access to providers, but they may come at a higher cost compared to public healthcare services.

Tips for Ensuring Access to Healthcare Providers

- Before purchasing a private healthcare plan, research the network of providers included in the plan to confirm that your preferred doctors, specialists, and hospitals are part of the network.

- Consider your healthcare needs and preferences when selecting a plan to ensure that you have access to the types of providers and services you require, such as mental health professionals, physical therapists, or alternative medicine practitioners.

- Regularly review your plan's network coverage and provider options to stay informed about any changes or additions that may affect your access to healthcare providers. Stay proactive in managing your healthcare coverage to optimize your healthcare experience as an entrepreneur.

Ultimate Conclusion

In conclusion, navigating the world of private healthcare as an entrepreneur requires careful consideration and knowledge of the available options. By being informed and proactive, entrepreneurs can ensure they make the right choices for their health and business.

Essential FAQs

What are the key benefits of private healthcare for entrepreneurs?

Private healthcare offers entrepreneurs more personalized care, quicker access to specialists, and the ability to customize their coverage based on their specific needs.

How does the cost of private healthcare compare to traditional health insurance plans?

Private healthcare can be more expensive upfront, but it often provides more comprehensive coverage and tailored services, making it a valuable investment for entrepreneurs.

What are some common limitations or exclusions in private healthcare plans?

Some private healthcare plans may not cover pre-existing conditions, certain elective procedures, or experimental treatments. It's important for entrepreneurs to carefully review these limitations before purchasing a plan.