Embark on a journey of understanding your homeowners insurance quote with this detailed guide. From unraveling policy coverage to deciphering premium costs, this introduction sets the stage for a thorough exploration, inviting readers to delve deeper into the complexities of insurance quotes.

In the following paragraphs, we will uncover the intricacies of homeowners insurance quotes, shedding light on key components and providing valuable insights to empower homeowners in making informed decisions.

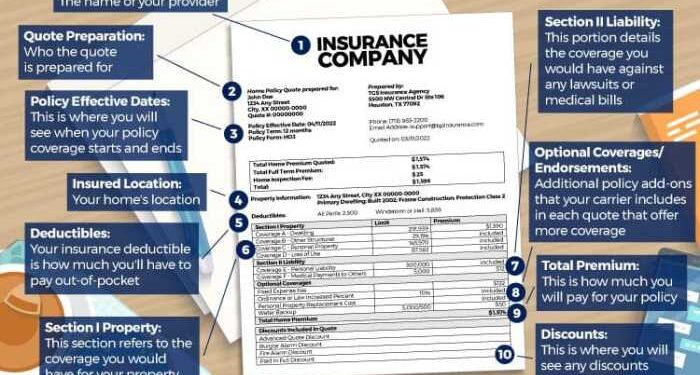

Understanding Homeowners Insurance Quote

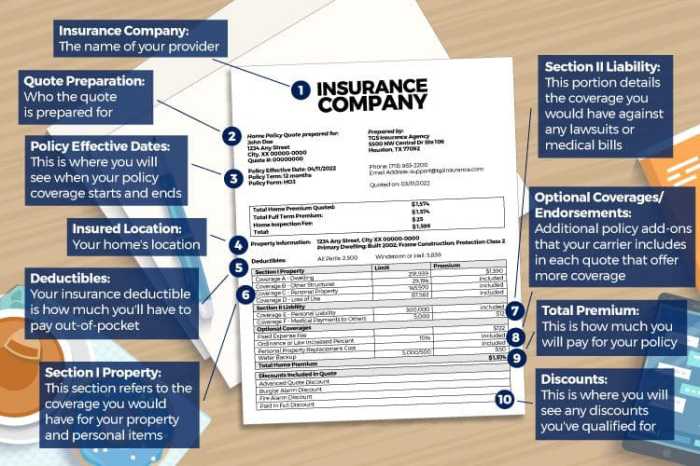

A homeowners insurance quote is an estimate provided by an insurance company detailing the cost and coverage of a policy for protecting a homeowner's property and belongings.

Key components typically found in a homeowners insurance quote include:

Coverage Details

- Property coverage for the physical structure of the home

- Liability coverage for injuries or property damage to others

- Personal property coverage for belongings inside the home

- Add-on options for additional coverage like flood or earthquake insurance

Premium and Deductible

- The premium is the cost of the insurance policy

- The deductible is the amount the homeowner pays out of pocket before the insurance kicks in

Understanding the quote is essential for homeowners to ensure they have adequate coverage to protect their investment in case of unforeseen events like natural disasters, theft, or accidents. It also helps homeowners compare different insurance options to find the best fit for their needs and budget.

Types of Homeowners Insurance Quotes

- Actual Cash Value (ACV) - Coverage for the cost of the property minus depreciation

- Replacement Cost Value (RCV) - Coverage for the full cost of repairing or replacing the property without accounting for depreciation

- Guaranteed Replacement Cost - Coverage that pays for repairing or replacing the property regardless of the cost

Deciphering Policy Coverage

Understanding the details of policy coverage in a homeowners insurance quote is crucial for homeowners to ensure they have the appropriate protection in place.

Dwelling Coverage

Dwelling coverage refers to the part of your policy that protects the physical structure of your home, including the walls, roof, foundation, and other attached structures like a garage or deck. It is important to have adequate dwelling coverage to cover the cost of rebuilding or repairing your home in case of damage.

Personal Property Coverage

Personal property coverage protects your belongings inside your home, such as furniture, clothing, electronics, and other valuables. It is essential to accurately estimate the value of your personal property to ensure you have enough coverage in case of theft, damage, or loss.

Liability Coverage

Liability coverage protects you in the event someone is injured on your property or if you accidentally damage someone else's property. This coverage can help cover legal expenses, medical bills, and other costs associated with a liability claim. It is important to have sufficient liability coverage to protect your assets in case of a lawsuit.

Coverage Limits

Coverage limits are the maximum amount your insurance company will pay for a covered loss. It is crucial to understand your coverage limits for dwelling, personal property, and liability to ensure you have adequate protection. Exceeding your coverage limits can leave you financially vulnerable in the event of a claim.

Examples of Policy Coverage

Scenario 1

A tree falls on your roof during a storm, causing damage to the structure of your home. Dwelling coverage would help cover the cost of repairs.

Scenario 2

A fire breaks out in your kitchen, destroying your appliances and furniture. Personal property coverage would help replace the damaged items.

Scenario 3

A guest slips and falls on your icy driveway, resulting in injuries. Liability coverage would help cover medical expenses and legal fees if the guest decides to file a lawsuit.

Determining Premium Costs

Determining premium costs in a homeowners insurance quote is crucial in understanding the overall financial impact of the policy. The premium cost is the amount you pay for the insurance coverage, typically on a monthly or annual basis. It is calculated based on various factors that assess the level of risk associated with insuring your home.

Factors Influencing Premium Costs

- The location of your home plays a significant role in determining the premium cost. Homes located in areas prone to natural disasters or high crime rates may have higher premiums.

- The age and condition of your home can impact the premium. Older homes or homes with outdated systems may be more costly to insure.

- Your home's replacement cost value is another key factor. The higher the replacement cost, the higher the premium.

- Your claims history and credit score can also influence the premium cost. A history of frequent claims or a low credit score may result in higher premiums.

Tips to Lower Premium Costs

- Consider increasing your deductible. A higher deductible typically results in a lower premium.

- Improve home security by installing smoke detectors, security alarms, or cameras to potentially lower your premium.

- Bundling your homeowners insurance with other policies like auto insurance from the same provider can often lead to discounts on premiums.

- Shop around and compare quotes from different insurance providers. Premium costs can vary significantly between companies, so it's essential to explore your options.

Comparison of Premium Costs

When comparing quotes from different insurance providers, you may notice significant variations in premium costs for similar coverage levels. It's essential to carefully review the coverage details and exclusions in each quote to understand why the costs may differ. Factors like the insurer's underwriting standards, claims experience in your area, and available discounts can all contribute to the differences in premium costs.

Understanding Deductibles

When it comes to homeowners insurance, understanding deductibles is crucial as it directly impacts the cost of your policy and the coverage you receive.

Definition of Deductible

A deductible is the amount of money you are responsible for paying out of pocket before your insurance coverage kicks in. For example, if you have a $1,000 deductible and file a claim for $5,000 in damages, you would pay the first $1,000 and your insurance would cover the remaining $4,000.

High Deductible vs. Low Deductible

High Deductible

Opting for a higher deductible typically results in lower monthly premiums. However, you will have to pay more out of pocket in the event of a claim.

Low Deductible

Choosing a lower deductible means higher monthly premiums but less money upfront if you need to file a claim.

Choosing the Right Deductible

Consider your financial situation and how much you can afford to pay out of pocket. If you have savings set aside for emergencies, you might opt for a higher deductible to save on premiums. On the other hand, if you prefer predictability in your expenses, a lower deductible might be a better choice.

Strategies for Managing Deductible Costs

Bundle Your Policies

Consider bundling your homeowners insurance with other policies, like auto insurance, to potentially save on premiums.

Increase Security Measures

Installing security systems or making home improvements can lower your risk of a claim, which could lead to lower premiums.

Review Annually

Regularly review your policy and deductible amount to ensure it still aligns with your needs and financial situation.

Epilogue

As we conclude this discussion on homeowners insurance quotes, remember that knowledge is power when it comes to protecting your home and assets. By mastering the art of interpreting quotes, homeowners can navigate the insurance landscape with confidence and peace of mind.

Top FAQs

What factors can influence the cost of homeowners insurance premiums?

Factors such as the location of your home, its age, the coverage limits you choose, and your claims history can all impact the cost of your insurance premiums.

How can homeowners lower their insurance premiums?

Homeowners can potentially lower their insurance premiums by bundling their policies, installing security systems, maintaining a good credit score, and exploring discounts offered by insurance providers.

What is the significance of choosing the right deductible?

Choosing the right deductible is crucial as it determines how much you'll have to pay out of pocket in the event of a claim. A higher deductible typically means lower premiums but higher out-of-pocket costs during a claim.