Embarking on the journey of finding real life insurance options that align with your budget opens up a world of possibilities. From understanding the importance of research to determining your financial limits and exploring different policy types, this guide will navigate you through the intricate realm of life insurance choices.

As you delve deeper into this topic, you'll uncover insights that demystify the process and empower you to make informed decisions about securing your financial future.

Researching Life Insurance Options

When it comes to securing a life insurance policy, it's crucial to conduct thorough research to ensure you find the best option that fits your needs and budget. Researching different life insurance options can help you make an informed decision and provide financial protection for your loved ones in the future.

Importance of Researching Different Life Insurance Options

- Compare Coverage: Researching allows you to compare the coverage offered by different insurance providers to find the most suitable one for your needs.

- Cost Analysis: By exploring various options, you can analyze the costs associated with different policies and choose one that fits your budget.

- Understand Terms and Conditions: Research helps you understand the terms and conditions of each policy, ensuring you are aware of what is covered and any limitations.

Tips for Finding Reputable Insurance Providers

- Check Ratings: Look for insurance companies with high ratings from reputable agencies to ensure financial stability and reliability.

- Read Reviews: Reading reviews from current or past policyholders can provide insights into the customer service and claims process of the insurance provider.

- Consult with an Advisor: Seeking advice from a financial advisor can help you navigate the complex world of life insurance and find a trustworthy provider.

Factors to Consider When Choosing a Life Insurance Policy

- Coverage Amount: Determine the amount of coverage needed based on your financial obligations and future needs.

- Policy Type: Understand the differences between term life, whole life, and other types of policies to choose the one that aligns with your goals.

- Premiums and Payments: Evaluate the premiums and payment options to ensure they are affordable and sustainable in the long run.

Determining Your Budget

Determining your budget for life insurance is a crucial step in finding the right policy that fits your financial situation. By assessing your finances and calculating how much you can afford to spend on premiums, you can set a realistic budget that provides you with the coverage you need without straining your finances.

Assessing Your Financial Situation

- Start by evaluating your monthly income and expenses to determine how much you can allocate towards life insurance.

- Take into account any existing debts, savings goals, and other financial obligations that may impact your budget.

- Consider your long-term financial goals, such as saving for retirement or your children's education, when setting your budget.

Calculating Affordability

- Use a simple formula to calculate how much you can afford to spend on life insurance: Monthly Income - Monthly Expenses = Available Funds for Premiums.

- Factor in any potential changes in your income or expenses in the future to ensure your budget remains sustainable.

- Consider the level of coverage you need and the type of policy that best suits your financial goals when determining affordability.

Setting a Realistic Budget

- It's important to set a budget that you can comfortably afford without sacrificing other financial priorities.

- Avoid overextending yourself by choosing a policy with premiums that strain your budget in the long run.

- Review your budget periodically to make adjustments as needed based on changes in your financial situation.

Types of Life Insurance Policies

Life insurance policies come in various types, each offering different benefits and features to policyholders. Understanding the differences between these policies can help you make an informed decision based on your needs and budget.

Term Life Insurance

Term life insurance is a type of life insurance that provides coverage for a specific period, such as 10, 20, or 30 years. It offers a death benefit to beneficiaries if the insured passes away during the term of the policy.

One of the main benefits of term life insurance is its affordability, making it an attractive option for many individuals. Premiums are typically lower compared to other types of life insurance, making it easier to fit into a budget. However, it is important to note that term life insurance does not build cash value like whole life insurance.

Whole Life Insurance

Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured individual. In addition to a death benefit, whole life insurance also accumulates cash value over time, which can be accessed through policy loans or withdrawals.

One key difference between whole life insurance and term life insurance is the cost, as whole life insurance tends to have higher premiums due to the cash value component. However, the cash value can serve as a source of savings and can potentially be used for various financial needs in the future.

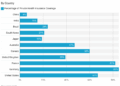

Comparison of Different Types of Life Insurance Policies

When comparing term life insurance and whole life insurance, it is essential to consider factors such as cost and coverage. Term life insurance is typically more affordable and provides coverage for a specific period, making it suitable for individuals who need temporary protection.

On the other hand, whole life insurance offers lifelong coverage and an investment component through cash value accumulation. While whole life insurance may have higher premiums, it provides a sense of security and a source of savings for the policyholder.In conclusion, choosing the right type of life insurance policy depends on your individual needs, budget, and financial goals.

It is important to assess your priorities and consult with a financial advisor to determine the most suitable option for you and your family.

Evaluating Coverage Needs

Determining the appropriate amount of coverage for your life insurance policy is crucial to ensure financial protection for your loved ones. Several factors come into play when evaluating your coverage needs, including your age, number of dependents, outstanding debts, and anticipated future expenses.

Factors Influencing Coverage Needs

- Age: Younger individuals may require less coverage compared to older individuals as they have fewer financial responsibilities.

- Dependents: The number of dependents you have, such as children or aging parents, will impact the amount of coverage needed to support their financial needs.

- Debts: Consider any outstanding debts, such as mortgages or student loans, that need to be covered to prevent burdening your loved ones in the future.

- Future Expenses: Anticipate future expenses like college tuition for your children, medical bills, or funeral costs to ensure adequate coverage.

Examples of Suitable Coverage Amounts

- If you are a young, single individual with minimal debt and no dependents, a lower coverage amount may be sufficient to cover funeral expenses and outstanding debts.

- For a middle-aged individual with a spouse and children, a higher coverage amount is necessary to replace lost income, pay off the mortgage, and cover future expenses like college tuition.

- An older individual nearing retirement may require a lower coverage amount to supplement retirement savings and cover any remaining debts or final expenses.

Ending Remarks

In conclusion, the quest for finding real life insurance options tailored to your budget is not just about numbers; it's about protecting what matters most. By following the steps Artikeld in this guide, you're on the path to safeguarding your loved ones and securing peace of mind for the future.

FAQs

How can I find reputable insurance providers?

Research online reviews, ask for recommendations from trusted sources, and check the financial stability ratings of insurance companies.

What factors should I consider when choosing a life insurance policy?

Factors to consider include your financial obligations, dependents, future expenses, and the coverage amount needed to secure your family's financial future.

What is the significance of setting a realistic budget for life insurance premiums?

Setting a realistic budget ensures that you can afford the premiums over the long term without straining your finances.