As How Home Renovations Can Change Your Homeowners Insurance Quote takes center stage, this opening passage beckons readers with casual formal language style into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

When it comes to renovating your home, the impact on your homeowners insurance is often overlooked. In this guide, we will delve into the various ways home renovations can alter your insurance quotes, offering valuable insights for homeowners looking to upgrade their living spaces.

How Home Renovations Impact Homeowners Insurance

When it comes to home renovations, it's important to consider how these changes can affect your homeowners insurance. Major renovations such as adding a swimming pool or upgrading electrical systems can have a significant impact on your insurance premiums and coverage.

Renovations and Insurance Premiums

Renovations that increase the value of your home, such as adding a swimming pool or a new addition, can lead to higher insurance premiums. This is because the overall replacement cost of your home has now increased, which means the insurance company may need to pay out more in the event of a claim.

Value of Renovations and Insurance Coverage

The value of the renovations you make to your home should be reflected in your insurance coverage. It's important to update your policy to ensure that your new renovations are adequately covered in case of damage or loss. Failure to update your policy could result in being underinsured for the value of your home improvements.

Common Renovation Projects Triggering Policy Updates

- Adding a swimming pool or hot tub

- Upgrading electrical systems

- Renovating the kitchen or bathroom

- Adding a new room or addition

Types of Home Renovations that Affect Insurance Quotes

When it comes to home renovations, certain changes can have a significant impact on your homeowners insurance quotes. Understanding how different types of renovations can influence insurance costs is crucial for homeowners looking to make upgrades to their properties.One of the key factors that can affect insurance rates is the type of renovation being done.

Here are some specific types of renovations that can impact your insurance premiums:

Roof Replacements

Replacing an old or damaged roof with a new one can potentially lower your insurance premiums. A sturdy, well-maintained roof is less likely to cause leaks or other damage, reducing the risk of claims for the insurance company.

Home Extensions

Adding an extension to your home can increase its overall value, which may result in higher insurance costs. However, if the extension includes additional safety features, such as updated electrical wiring or fire-resistant materials, it could actually lead to lower insurance premiums.

Kitchen Remodels

Upgrading your kitchen with modern appliances, fire alarms, and sprinkler systems can improve the safety of your home. This can reduce the risk of fires or other accidents, potentially resulting in lower insurance rates.

Materials Used in Renovations

The materials used in your renovations can also affect your insurance costs. For example, using fire-resistant materials like metal roofing or impact-resistant windows can lower your premiums by reducing the risk of damage from hazards like fire or severe weather.

Increased Home Safety Features

Installing safety features such as burglar alarms, smoke detectors, and security cameras can make your home less vulnerable to risks like theft or vandalism. Insurance companies often offer discounts for homes with these added security measures, leading to lower insurance premiums.Overall, when planning home renovations, it's important to consider how the changes you make can impact your homeowners insurance rates.

By focusing on safety and using high-quality materials, you can potentially lower your insurance costs while improving the value and security of your home.

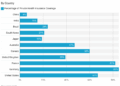

Factors Considered by Insurers When Adjusting Quotes

When it comes to adjusting homeowners insurance quotes based on home renovations, insurers take into account various factors to assess the risks involved and determine appropriate coverage.Insurers consider the age of the home, location, and the overall impact of renovations on the property when adjusting quotes.

These factors help insurers understand the potential risks associated with the property and calculate the cost of coverage accordingly

Risk Assessment for Different Types of Home Renovations

Insurers evaluate the type of renovations done on a property to determine the level of risk involved. Major renovations, such as adding a swimming pool or upgrading electrical systems, can increase the risk of accidents or damages, leading to higher insurance premiums.

On the other hand, renovations that enhance safety and security, like installing a new roof or upgrading plumbing, may result in lower insurance costs.

Importance of Notifying Insurance Companies

It is crucial for homeowners to inform their insurance companies about any renovations done to their property. Failing to do so can lead to inadequate coverage in case of a claim. By notifying insurers about renovations, homeowners ensure that their policy accurately reflects the current state of the property and that they are adequately protected.

Tips for Managing Insurance Costs During Home Renovations

When undertaking home renovations, it is essential to consider how it can affect your homeowners insurance costs. Here are some strategies to help you manage insurance costs effectively throughout the renovation process.

Review Your Policy Before Starting Renovations

Before you begin any renovations, review your current homeowners insurance policy. Make sure you understand what is covered and what is not. If you are planning significant renovations that will increase your home's value, you may need to adjust your coverage to ensure you are adequately protected.

Inform Your Insurance Provider

It is crucial to inform your insurance provider about the renovations you plan to undertake. They can advise you on any changes you may need to make to your policy to ensure you are adequately covered during and after the renovation process.

Consider Increasing Your Liability Coverage

During renovations, there is an increased risk of accidents happening on your property. Consider increasing your liability coverage to protect yourself in case someone gets injured on your property during the renovation process.

Shop Around for Insurance Quotes After Renovations

Once the renovations are complete, consider shopping around for insurance quotes to find the best rates. Different insurance providers may offer varying rates based on the updated value of your home. By comparing quotes, you can ensure you are getting the best coverage at the most competitive price.

Document the Renovation Process

Keep detailed records of the renovation process, including receipts, contracts, and before-and-after photos. This documentation can be valuable in case you need to file a claim with your insurance provider in the future.

Regularly Review and Update Your Policy

Even after the renovations are complete, it is essential to regularly review and update your homeowners insurance policy. As your home's value changes over time, your coverage needs may also evolve. Stay proactive in ensuring your policy aligns with your home's current value and your insurance needs.

Wrap-Up

In conclusion, the relationship between home renovations and homeowners insurance quotes is intricate and multifaceted. By understanding how renovations can affect insurance premiums, coverage, and overall costs, homeowners can make informed decisions to safeguard their investments. Stay informed, stay protected, and enjoy the benefits of a renovated home with peace of mind.

Answers to Common Questions

How do major renovations impact homeowners insurance?

Major renovations like adding a swimming pool or upgrading electrical systems can lead to increased insurance premiums due to higher replacement costs and liability risks.

What types of renovations affect insurance quotes the most?

Renovations such as roof replacements, home extensions, and kitchen remodels tend to have a significant impact on insurance rates, as they increase the overall value and risk associated with the property.

What factors do insurers consider when adjusting quotes after renovations?

Insurers evaluate risks based on the type of renovations, age of the home, location, and the impact of the upgrades. It's crucial to notify insurers about renovations to ensure proper coverage.

How can homeowners manage insurance costs during renovations?

Homeowners can mitigate cost increases by planning renovations carefully, updating their coverage as needed, and shopping around for competitive insurance quotes post-renovation.