Exploring the realm of Cheap Small Business Insurance That Doesn’t Cut Corners, this guide beckons readers with a wealth of valuable insights, ensuring an enriching reading experience that is both informative and unique.

Delve into the following sections to gain a deeper understanding of how to secure affordable yet reliable insurance for your small business.

Researching Cheap Small Business Insurance

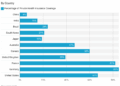

When researching affordable small business insurance, there are several key factors to consider to ensure you get the coverage you need without breaking the bank. It's essential to compare quotes from different insurance providers to find the best deal that suits your budget and offers adequate protection for your business.

Importance of Comparing Quotes

- By comparing quotes from different insurance providers, you can find the most cost-effective option that offers the coverage your business requires.

- It allows you to see the range of premiums offered by various insurers, giving you a better understanding of what is available in the market.

- Comparing quotes also helps you avoid overpaying for coverage that you may not need, ensuring you get the best value for your money.

Role of Coverage Limits

- Coverage limits play a crucial role in balancing affordability and adequate protection for your business.

- It's important to assess your business's risks and choose coverage limits that provide sufficient protection without paying for unnecessary coverage.

- Consider factors such as the size of your business, the industry you operate in, and the specific risks you face when determining the appropriate coverage limits.

Types of Coverage Needed

When it comes to small business insurance, there are several types of coverage that are essential to protect your business from various risks and liabilities. Understanding the different types of insurance coverage available can help you make informed decisions to safeguard your business assets and operations.

General Liability Insurance

General liability insurance is crucial for small businesses as it provides protection against claims of bodily injury, property damage, and advertising injury. This type of insurance can cover legal fees, medical expenses, and settlements in case your business is sued for accidents or negligence.

It offers a broad level of coverage that can help protect your business from unforeseen events and potential financial losses.

Professional Liability Insurance vs. Commercial Property Insurance

Professional liability insurance, also known as errors and omissions insurance, is designed to protect businesses that provide professional services or advice. It covers claims of negligence, errors, or omissions that may arise from the services you provide. On the other hand, commercial property insurance protects your business property, including buildings, equipment, inventory, and other assets, from risks such as fire, theft, vandalism, or natural disasters.While professional liability insurance focuses on protecting your business from claims related to your services, commercial property insurance safeguards your physical assets.

Both types of insurance are important for small businesses, but they serve different purposes in ensuring comprehensive coverage for your business operations.

Avoiding Coverage Gaps

When it comes to small business insurance, avoiding coverage gaps is crucial to ensuring your business is protected in times of need. Coverage gaps can leave your business vulnerable to financial risks and liabilities that could have serious consequences. Here are some common pitfalls to watch out for and strategies to ensure comprehensive coverage without breaking the bank.

Common Pitfalls Leading to Coverage Gaps

- Underinsuring: One of the most common pitfalls is underestimating the value of your business assets and liabilities, leading to insufficient coverage.

- Ignoring specific risks: Failing to identify and address specific risks unique to your business can result in coverage gaps when a claim arises.

- Not updating policies: Changes in your business, such as expansion or new services, may not be reflected in your insurance policies, leaving you exposed to coverage gaps.

Strategies for Comprehensive Coverage

- Regular policy reviews: Conduct regular reviews of your insurance policies to ensure they align with your current business needs and risks.

- Work with a knowledgeable agent: Seek guidance from an experienced insurance agent who can help you understand your coverage options and tailor a policy to your business.

- Consider package policies: Bundle multiple types of coverage, such as general liability and property insurance, into a package policy for cost-effective comprehensive coverage.

Consequences of Coverage Gaps

- Financial losses: Coverage gaps can result in out-of-pocket expenses for claims that are not covered by your insurance, potentially causing financial strain on your business.

- Lawsuits and legal liabilities: Without adequate coverage, your business may face lawsuits and legal liabilities that could threaten its reputation and future operations.

- Business interruption: Coverage gaps can lead to disruptions in your business operations, affecting revenue streams and customer relationships.

Tips for Finding Affordable Policies

When it comes to finding affordable small business insurance policies, there are several strategies you can implement to lower your premiums and optimize your coverage cost-effectively. Below are some tips to help you navigate the process and secure the best possible insurance options for your business.

Negotiating Lower Premiums

- Research and compare quotes from multiple insurance providers to leverage competitive pricing.

- Consider increasing your deductible to lower your premium costs, but ensure it is still manageable for your business in the event of a claim.

- Ask your insurance provider about available discounts or special offers that you may qualify for based on your business type or safety measures in place.

Optimizing Coverage Cost-Effectively

- Review your coverage needs regularly and adjust your policy accordingly to avoid over-insuring or under-insuring your business.

- Bundle multiple insurance policies with the same provider to qualify for discounts and streamline your coverage under one plan.

- Implement risk management practices and safety measures within your business to demonstrate lower risk to insurers and potentially reduce premiums.

Closure

In conclusion, navigating the landscape of affordable small business insurance without compromising quality is indeed possible. By following the recommendations Artikeld in this guide, businesses can safeguard their interests effectively.

General Inquiries

What factors should I consider when researching affordable small business insurance?

Factors to consider include the level of coverage needed, the reputation of the insurance provider, and any specific industry requirements.

Why is general liability insurance important for small businesses?

General liability insurance protects businesses from third-party claims of bodily injury, property damage, and advertising mistakes.

How can I avoid coverage gaps in my small business insurance policy?

To avoid gaps, review your policy regularly, work with a knowledgeable agent, and ensure you have coverage for all potential risks.

What are some tips for negotiating lower premiums with insurance providers?

Tips include bundling policies, improving your business's risk profile, and shopping around for competitive quotes.