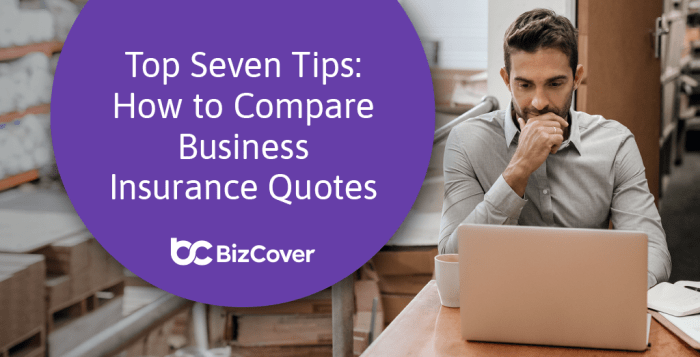

Exploring the realm of insurance comparison tools for businesses, this guide offers valuable insights and practical advice to streamline the process of finding the right coverage.

From understanding the nuances of different insurance types to leveraging online tools effectively, this guide covers all aspects essential for making informed decisions.

Researching Insurance Providers

When it comes to finding the right insurance provider for your business, thorough research is key to making an informed decision. Here are some essential factors to consider when comparing insurance providers:

Identify Key Factors to Consider

- Coverage Options: Look for insurance providers that offer a wide range of coverage options tailored to your business needs.

- Cost: Compare quotes from different providers to ensure you are getting the best value for your money.

- Claims Process: Research how easy and efficient the claims process is with each insurance provider.

- Customer Service: Read reviews and testimonials to gauge the level of customer service provided by each insurance company.

Importance of Reputation and Financial Stability

It is crucial to consider the reputation and financial stability of insurance companies before making a decision. A company's reputation can give you insight into their reliability and customer satisfaction. Additionally, assessing the financial stability of an insurance provider can help ensure they will be able to fulfill their financial obligations in the event of a claim.

Types of Business Insurance

When it comes to protecting your business, having the right insurance coverage is crucial. There are different types of insurance policies available to businesses, each serving a specific purpose and offering different levels of protection.

General Liability Insurance

General liability insurance is designed to protect your business from claims of bodily injury, property damage, and advertising injury. This type of insurance can cover legal fees, medical expenses, and settlements in case your business is sued for negligence.

- General liability insurance is essential for businesses that interact with customers, clients, or vendors.

- It provides coverage for accidents that occur on your business premises or as a result of your business operations.

- Having general liability insurance can give you peace of mind and protect your business from unforeseen events.

Property Insurance

Property insurance helps protect your business property, including buildings, equipment, inventory, and furniture, from risks such as fire, theft, vandalism, and natural disasters. This type of insurance can help cover the cost of repairs or replacement of damaged property.

- Property insurance is crucial for businesses that own or lease physical space for their operations.

- It can also cover business interruption expenses if your operations are temporarily halted due to property damage.

- Having property insurance can safeguard your business assets and ensure continuity of operations in case of unexpected events.

Workers' Compensation Insurance

Workers' compensation insurance is mandatory in most states and provides coverage for employees who are injured or become ill while performing their job duties. This type of insurance can help cover medical expenses, lost wages, and rehabilitation costs for injured workers.

- Workers' compensation insurance is essential for businesses with employees, as it protects both the workers and the employer in case of workplace injuries.

- It can help prevent costly lawsuits and ensure that injured employees receive the necessary support and benefits.

- Having workers' compensation insurance demonstrates your commitment to the well-being of your employees and compliance with legal requirements.

Online Insurance Comparison Tools

When it comes to comparing insurance quotes for your business, utilizing online tools can save you time and effort. These platforms allow you to easily compare different insurance providers and policies to find the best coverage for your specific needs.

List of Popular Online Tools for Comparing Insurance Quotes:

- Insurance.com

- The Zebra

- Policygenius

- Insure.com

Features and Benefits of Using Online Insurance Comparison Platforms:

- Convenience: Easily compare multiple quotes from different insurers in one place.

- Saves Time: Avoid the hassle of contacting individual insurance companies for quotes.

- Cost-Effective: Helps you find the most competitive rates for your business insurance needs.

- Transparency: Provides clear and detailed information on coverage options and premiums.

Tips on How to Effectively Use Online Tools to Get Accurate Insurance Quotes:

- Provide Accurate Information: Make sure to enter correct details about your business to receive accurate quotes.

- Compare Multiple Quotes: Don't settle for the first quote you receive, compare multiple options to find the best coverage at the best price.

- Review Policy Details: Take the time to read through the policy details to understand what is covered and what is not.

- Seek Professional Advice: If you're unsure about certain terms or coverage options, seek advice from an insurance professional.

Factors to Consider When Comparing Quotes

When comparing insurance quotes for your business, there are several key factors to keep in mind to ensure you are getting the right coverage at the best price. Understanding how coverage limits, deductibles, and premiums impact the overall cost is crucial in making an informed decision.

It is also essential to review policy details and exclusions to avoid any surprises in the event of a claim.

Coverage Limits

- Consider the specific needs of your business and choose coverage limits that adequately protect your assets and liabilities.

- Higher coverage limits may result in higher premiums, but could provide better protection in case of a significant loss.

- Review the limits for different types of coverage, such as liability, property, and business interruption insurance.

Deductibles

- Compare deductible options offered by different insurance providers and understand how they affect your premium.

- Choosing a higher deductible can lower your premium, but you will be responsible for paying more out of pocket in the event of a claim.

- Evaluate your risk tolerance and financial capacity to determine the best deductible for your business.

Premiums

- Compare premiums from multiple providers to ensure you are getting competitive rates for the coverage you need.

- Consider any discounts or incentives offered by insurance companies that could help lower your premium.

- Remember that the lowest premium may not always provide the best coverage, so balance cost with the level of protection required.

Policy Details and Exclusions

- Thoroughly review the policy details, including what is covered, excluded, and any limitations or restrictions.

- Understand the conditions under which your policy will pay out and any circumstances that may invalidate your coverage.

- Ask questions and seek clarification on any aspects of the policy that are unclear to avoid surprises when filing a claim.

Working with Insurance Brokers

Insurance brokers play a crucial role in helping businesses navigate the complex world of insurance and compare quotes effectively. They act as intermediaries between businesses and insurance providers, offering expert advice and guidance throughout the process.

Benefits of Working with an Insurance Broker

- Personalized Service: Insurance brokers take the time to understand your business needs and tailor insurance solutions accordingly.

- Expertise and Guidance: Brokers have in-depth knowledge of the insurance market and can recommend the most suitable policies for your business.

- Access to Multiple Providers: Brokers have access to a wide network of insurance providers, giving you more options to choose from.

- Claims Assistance: Brokers assist with claims processing and ensure that you receive fair compensation in case of an incident.

Tips for Finding a Reliable Insurance Broker

- Check Credentials: Look for brokers who are licensed and have a good reputation in the industry.

- Ask for Recommendations: Seek referrals from other business owners or professionals who have worked with insurance brokers before.

- Interview Potential Brokers: Meet with different brokers to discuss your needs and assess their knowledge and communication skills.

- Review Contracts Carefully: Before signing any agreements, make sure to review the terms and conditions of the broker-client relationship.

Case Studies and Examples

In this section, we will explore real-life examples of businesses that benefited from comparing insurance quotes and selecting the right coverage for their needs.

Case Study 1: Small Retail Store

A small retail store owner decided to compare insurance quotes for their business after realizing they were overpaying for coverage they didn't need. By using online comparison tools, they were able to find a more affordable policy that still provided adequate protection.

As a result, they saved hundreds of dollars annually, which they could then reinvest back into their business for growth and expansion.

Case Study 2: Tech Startup

A tech startup company initially struggled to find the right insurance coverage to protect their unique business operations. After working with an insurance broker to compare quotes from different providers, they were able to tailor a policy that addressed their specific risks and liabilities.

This decision not only safeguarded their financial stability but also gave them the confidence to pursue new opportunities and scale their business.

Case Study 3: Construction Company

A construction company faced a significant financial setback due to inadequate insurance coverage when a workplace accident occurred. After reevaluating their insurance needs and comparing quotes from various providers, they were able to secure a comprehensive policy that offered better protection for their employees and projects.

This proactive approach not only prevented further financial losses but also enhanced their reputation within the industry.

Closing Summary

In conclusion, navigating the landscape of insurance quotes can be complex, but armed with the best tools and knowledge, businesses can secure suitable coverage that protects their interests and fosters growth.

General Inquiries

What are some key factors to consider when comparing insurance providers?

Factors such as reputation, financial stability, and customer reviews play a crucial role in determining the reliability of insurance providers.

Why is it essential to have a comprehensive insurance policy for a business?

A comprehensive policy ensures that all potential risks are covered, protecting the business from unforeseen circumstances that could lead to financial losses.

How can businesses benefit from working with insurance brokers?

Insurance brokers provide personalized advice, access to a wide range of insurance options, and help in navigating complex policy details, ensuring businesses get tailored coverage.