As Best health insurance plans for expats in 2025 take the spotlight, this opening passage invites readers into a realm of well-researched information, ensuring an engaging and unique reading experience.

The second paragraph will provide a detailed and informative overview of the topic.

Overview of Health Insurance Plans for Expats in 2025

Health insurance is crucial for expats living abroad as it provides access to quality healthcare services, financial protection in case of medical emergencies, and peace of mind knowing that their health needs are covered.

When choosing health insurance plans, expats typically look for key features such as comprehensive coverage, including outpatient, inpatient, and emergency services, access to a wide network of healthcare providers, international coverage for travel, and flexibility in terms of plan customization to suit their individual needs.

Evolution of Health Insurance Needs for Expats by 2025

As we look ahead to 2025, the health insurance needs of expats are expected to evolve in response to changing global healthcare trends and the increasing demand for digital health solutions. Expats may prioritize telemedicine services, wellness programs, and mental health coverage in their insurance plans.

Moreover, there may be a greater emphasis on preventive care and health screenings to promote overall well-being and early detection of health issues.

Trends in Health Insurance Coverage for Expats

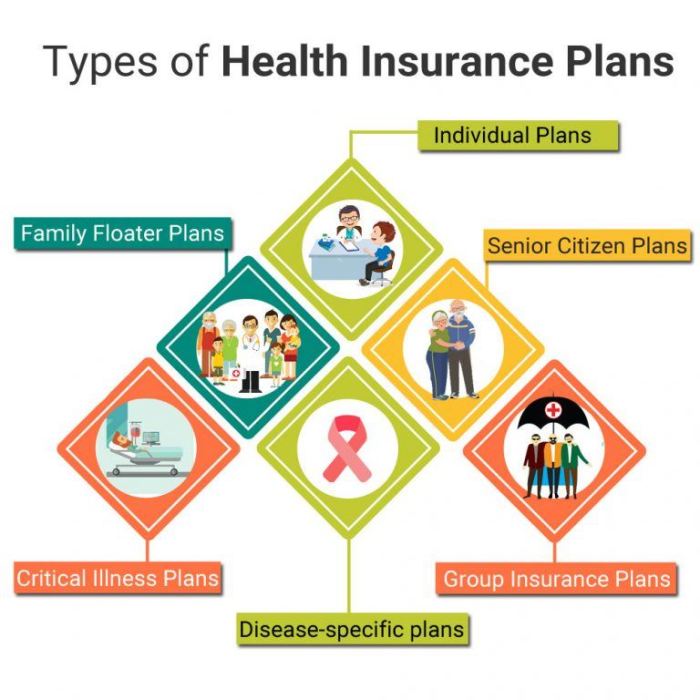

As the landscape of health insurance for expats continues to evolve, it is important to stay informed about the latest trends in coverage, premium costs, and services offered. Let's take a closer look at how different health insurance plans for expats compare, the changing premium costs, and the inclusion of telemedicine services.

Comparison of Coverage Offered by Different Health Insurance Plans

When comparing health insurance plans for expats, it is crucial to consider the extent of coverage provided. Some plans may offer comprehensive coverage that includes routine check-ups, emergency care, hospital stays, and prescription medication, while others may have more limited coverage options.

It is essential for expats to carefully review and compare the coverage offered by different plans to ensure they meet their specific healthcare needs.

Analyze the Trends in Premium Costs for Expat Health Insurance

The trend in premium costs for expat health insurance is influenced by various factors such as age, location, coverage level, and pre-existing conditions. In recent years, there has been a noticeable increase in premium costs due to rising healthcare expenses and inflation.

Expats should be prepared to budget for potentially higher premium costs and explore ways to mitigate these expenses, such as choosing a plan with a higher deductible or opting for a more basic coverage option.

Discussion on the Inclusion of Telemedicine Services

With the advancement of technology, many health insurance plans for expats now include telemedicine services as part of their offerings. Telemedicine allows expats to consult with healthcare providers remotely, through video calls or phone consultations, eliminating the need for in-person visits.

This trend is particularly beneficial for expats living in remote areas or countries with limited access to healthcare facilities. The inclusion of telemedicine services in health insurance plans enhances convenience, accessibility, and timely healthcare delivery for expats.

International Coverage and Network Providers

International coverage is a crucial aspect of health insurance plans for expats, as it ensures that individuals living abroad have access to quality healthcare services no matter where they are in the world. This feature provides peace of mind and security, especially when facing unexpected medical emergencies in a foreign country.

Popular Global Network Providers

- One of the popular global network providers associated with health insurance for expats is Cigna Global. They offer a wide network of healthcare providers in various countries, ensuring expats can receive quality care wherever they are located.

- Another well-known network provider is Allianz Care, which has a strong presence in multiple countries and offers comprehensive coverage for expats. They have partnerships with top hospitals and medical facilities globally.

- Bupa Global is also a trusted name in international health insurance, with a vast network of healthcare providers worldwide. Expats can benefit from their extensive coverage and access to top-tier medical services.

Benefits of Accessing a Wide Network of Healthcare Providers Worldwide

Having access to a broad network of healthcare providers worldwide offers several advantages for expats. It ensures that individuals can receive medical treatment from reputable doctors and hospitals, regardless of their location. This network also allows expats to choose healthcare facilities that best suit their needs and preferences, offering flexibility and convenience in accessing healthcare services.

Additionally, a wide network of providers can help reduce out-of-pocket expenses for expats, as they may have access to discounted rates negotiated by their insurance provider.

Customization and Flexibility in Health Insurance Plans

Customization and flexibility in health insurance plans for expats have become increasingly important in 2025. With the diverse needs and preferences of expatriates, insurance providers are adapting to offer more personalized options to cater to individual requirements. This shift towards personalized plans has significantly impacted the overall healthcare experience for expats, providing them with greater control and choice over their coverage.

Tailored Coverage Options

- Customizable Deductibles: Expats can now choose their deductible amount based on their budget and healthcare needs. This flexibility allows them to adjust their out-of-pocket expenses accordingly.

- Additional Benefits Add-Ons: Insurance plans now offer a variety of add-on benefits that expats can include in their coverage, such as maternity care, dental coverage, mental health services, and wellness programs.

- Flexible Network Options: Expats can select their preferred network of healthcare providers, both locally and internationally, ensuring access to quality care wherever they are located.

Personalized Wellness Programs

- Health Risk Assessments: Insurance companies are providing expats with personalized health risk assessments to identify potential health issues and offer preventive care strategies.

- Telemedicine Services: Many health insurance plans now include telemedicine services, allowing expats to consult with healthcare professionals remotely, making healthcare more convenient and accessible.

- Wellness Incentives: Some insurance providers offer wellness incentives to encourage healthy lifestyle choices among expats, such as discounts on gym memberships or rewards for achieving health goals.

Last Recap

Concluding this discussion on Best health insurance plans for expats in 2025, we summarize the key points in a captivating manner, leaving readers with a lasting impression.

FAQ Section

What are the key features expats look for in health insurance plans?

Expats often seek comprehensive coverage, including international coverage, flexible options, and access to a wide network of healthcare providers.

How are health insurance plans adapting to offer more customization options for expats?

Health insurance plans are becoming more flexible by allowing expats to choose personalized features such as telemedicine services, wellness programs, and tailored coverage options.

Why is international coverage important for expats in health insurance plans?

International coverage ensures that expats have access to quality healthcare services worldwide, providing a sense of security and peace of mind while living abroad.