Embarking on the journey to explore the realm of Best Affordable Life Insurance for Over 50s in 2025, this introductory passage aims to intrigue and inform the audience, paving the way for a deeper dive into this crucial topic.

Diving further into the nuances of life insurance for individuals over 50, this paragraph sets the stage for a comprehensive discussion ahead.

Introduction to Affordable Life Insurance for Over 50s

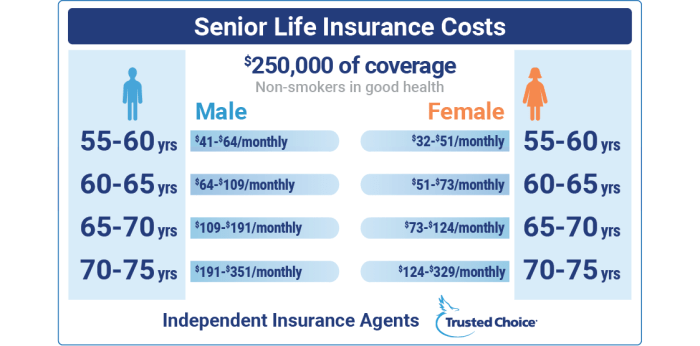

Life insurance plays a crucial role in providing financial security for individuals over 50. It ensures that loved ones are taken care of in the event of unexpected circumstances like illness or death. Finding affordable options is especially important for this age group as they may be nearing retirement and have limited income sources.

Key Factors for Affordable Life Insurance

- Age: Younger individuals typically pay lower premiums as they are considered lower risk.

- Health: Good health can lead to lower premiums, while pre-existing conditions may increase costs.

- Coverage Amount: Choosing a coverage amount that meets your needs without being excessive can help keep premiums affordable.

- Term Length: Opting for a shorter term length can result in lower premiums compared to longer terms.

- Insurance Provider: Comparing quotes from different insurance providers can help find the most affordable option.

Types of Life Insurance Policies for Over 50s

Term life insurance is a type of policy that provides coverage for a specific period, typically ranging from 10 to 30 years. It is usually more affordable than whole life insurance and can be a suitable option for individuals over 50 who are looking for coverage for a specific time frame, such as until retirement or until their mortgage is paid off.Whole life insurance, on the other hand, provides coverage for the entire lifetime of the policyholder.

It also includes a cash value component that grows over time, allowing policyholders to accumulate savings that can be accessed during their lifetime. This type of policy can be beneficial for individuals over 50 who want lifelong coverage and the option to build cash value.

Comparison of Different Types of Life Insurance Policies

- Term Life Insurance:

- Provides coverage for a specific term

- Lower premiums compared to whole life insurance

- No cash value component

- Suitable for short-term needs

- Whole Life Insurance:

- Provides coverage for the entire lifetime

- Higher premiums compared to term life insurance

- Includes a cash value component

- Can be used as an investment tool

Factors Affecting Affordable Life Insurance for Over 50s

When it comes to affordable life insurance for individuals over 50, there are several factors that can influence the cost of premiums. These factors can include health conditions, lifestyle choices, and other personal circumstances. Understanding how these factors impact the affordability of life insurance can help individuals make informed decisions when choosing a policy.

Health Conditions

Health conditions play a significant role in determining the cost of life insurance for individuals over 50. Insurance companies typically assess the health of the individual through a medical examination or by reviewing their medical history

On the other hand, individuals who are in good health are likely to qualify for lower premiums.

Lifestyle Choices

Apart from health conditions, lifestyle choices can also affect the cost of life insurance for individuals over 50. Factors such as smoking, excessive alcohol consumption, or engaging in high-risk activities can increase the risk of premature death, leading to higher premiums.

On the contrary, maintaining a healthy lifestyle, exercising regularly, and following a balanced diet can help reduce the cost of life insurance.

Tips for Finding the Best Affordable Life Insurance in 2025

When looking for the best affordable life insurance options for over 50s in 2025, it's essential to consider various strategies to ensure you make an informed decision that meets your needs and budget. Below are some tips to help you navigate the process effectively.

Comparing Quotes from Different Insurance Providers

- Request quotes from multiple insurance providers to compare premiums, coverage options, and benefits.

- Consider using online comparison tools to streamline the process and get a comprehensive view of available options.

- Look beyond the initial premium cost and assess the overall value of the policy in terms of coverage and benefits.

Reviewing and Updating Existing Life Insurance Policies

- Regularly review your existing life insurance policies to ensure they still align with your current financial situation and goals.

- Consider updating your coverage amount or policy type based on changes in your life circumstances, such as marriage, retirement, or the birth of a child.

- Consult with a financial advisor or insurance professional to assess the adequacy of your current coverage and make any necessary adjustments.

Leveraging Technology to Find the Best Affordable Life Insurance Options

- Explore online platforms and tools that allow you to compare insurance policies, read customer reviews, and analyze pricing structures.

- Utilize insurance aggregator websites to quickly gather quotes from multiple providers and identify the most competitive offers.

- Consider using mobile apps designed for insurance comparison and management to stay informed about the latest deals and promotions.

End of Discussion

Concluding our exploration of Best Affordable Life Insurance for Over 50s in 2025, this final section encapsulates the key takeaways and leaves the readers with a sense of clarity and understanding.

FAQ Compilation

What factors determine the cost of life insurance for individuals over 50?

The cost of life insurance for individuals over 50 is influenced by factors such as age, health status, coverage amount, and lifestyle choices.

How can one compare quotes from different insurance providers effectively?

To compare quotes effectively, individuals can use online comparison tools, seek assistance from insurance brokers, and carefully review the coverage details of each policy.

Is it necessary to review and update existing life insurance policies regularly?

Yes, it is crucial to review and update existing life insurance policies regularly to ensure that they align with current financial needs and circumstances.

Can technology be leveraged to find the best affordable life insurance options for individuals over 50?

Technology can indeed be utilized to compare quotes, research different policies, and explore various options to find the most suitable and affordable life insurance for individuals over 50.