Delving into the realm of Affordable Private Health Cover Options for Small Companies, we uncover key insights and strategies that can revolutionize the healthcare benefits landscape for small businesses.

Exploring the nuances of various private health cover options, this guide aims to empower small companies to make informed decisions that prioritize both affordability and comprehensive coverage for their employees.

Affordable Private Health Cover Options for Small Companies

Private health cover can be affordable for small companies due to various key factors such as group rates, customized plans, and tax benefits.

Importance of Offering Private Health Cover as a Benefit

- Enhances employee retention and satisfaction.

- Improves overall health and productivity of the workforce.

- Helps attract top talent to the company.

Types of Private Health Cover Options

There are different types of private health cover options suitable for small companies, including:

- Basic Hospital Cover: Covers essential hospital treatments and procedures.

- Extras Cover: Includes services like dental, optical, and physiotherapy.

- Combined Cover: Combines hospital and extras cover for comprehensive protection.

Strategies for Negotiating Affordable Plans

- Compare quotes from multiple insurance providers to find the best rates.

- Consider higher excess or co-payments to lower premium costs.

- Customize plans based on the specific needs of your employees to avoid unnecessary expenses.

- Explore government incentives or subsidies for small businesses offering health cover.

Types of Private Health Cover Plans

Private health cover plans for small companies can vary in terms of structure, cost, and benefits. Understanding the differences between traditional health insurance plans, health maintenance organizations (HMOs), high-deductible health plans (HDHPs), preferred provider organizations (PPOs), self-funded health plans, health reimbursement arrangements (HRAs), and health savings accounts (HSAs) is crucial for making informed decisions when selecting the right coverage option.

Traditional Health Insurance Plans vs. Health Maintenance Organizations (HMOs)

Traditional health insurance plans typically offer a broad network of healthcare providers, allowing employees to choose their doctors and specialists without referrals. On the other hand, HMOs require employees to select a primary care physician (PCP) and obtain referrals to see specialists within the network.

HMOs often have lower out-of-pocket costs but limited provider choices compared to traditional plans.

High-Deductible Health Plans (HDHPs) vs. Preferred Provider Organizations (PPOs)

- HDHPs have lower monthly premiums but higher deductibles, making them suitable for employees who are generally healthy and do not require frequent medical care. These plans are often paired with health savings accounts (HSAs) to help employees save for medical expenses.

- PPOs offer more flexibility in choosing healthcare providers and do not require referrals to see specialists. While PPOs have higher monthly premiums compared to HDHPs, they typically have lower out-of-pocket costs and more comprehensive coverage.

Self-Funded Health Plans

Self-funded health plans involve the employer directly assuming the financial risk for providing healthcare benefits to employees. While self-funded plans offer more flexibility in plan design and cost savings potential, they also come with the risk of higher expenses in case of unexpected medical claims.

Health Reimbursement Arrangements (HRAs) and Health Savings Accounts (HSAs)

- HRAs allow employers to reimburse employees for qualified medical expenses, offering a tax-advantaged way to provide healthcare benefits. However, HRAs are solely funded by the employer.

- HSAs are individual savings accounts that employees can use to pay for qualified medical expenses. Contributions to HSAs can come from both the employer and the employee, offering a tax-advantaged way to save for healthcare costs.

Factors Influencing Affordable Private Health Cover

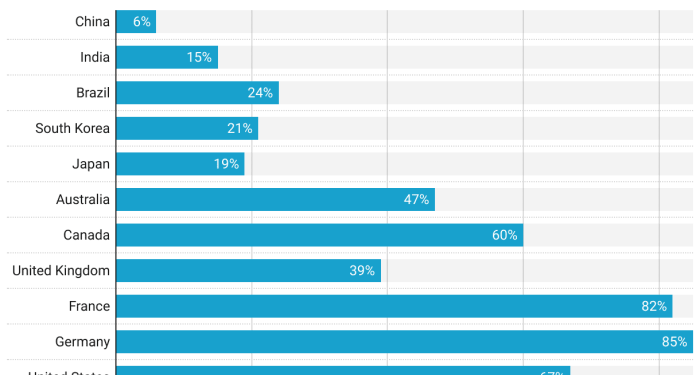

Employee demographics play a crucial role in determining the affordability of private health cover for small companies. Factors such as age, health status, and number of dependents can significantly impact the overall cost of providing health insurance to employees.

Cost-sharing Strategies

Implementing cost-sharing strategies can help reduce the financial burden of private health cover on small companies. For example, offering high-deductible health plans paired with health savings accounts can lower premiums while still providing coverage for major medical expenses

- Employer contributions to health savings accounts

- Copayments and coinsurance for medical services

- Employee wellness incentives

Wellness Programs and Preventive Care Initiatives

Incorporating wellness programs and preventive care initiatives can have a positive impact on the affordability of private health cover for small companies. By promoting healthy lifestyles and early detection of health issues, companies can reduce healthcare costs in the long run.

- On-site health screenings and vaccinations

- Nutrition and fitness programs

- Mental health resources and counseling services

Technology and Telemedicine Services

Leveraging technology and telemedicine services can make private health cover more affordable for small companies. By offering virtual consultations and remote monitoring options, companies can lower healthcare costs and improve access to care for employees.

- Telemedicine for non-emergency medical consultations

- Digital health platforms for managing chronic conditions

- Health apps for promoting healthy behaviors and tracking progress

Case Studies and Success Stories

In this section, we will explore case studies and success stories of small companies that have successfully implemented affordable private health cover options for their employees. We will also discuss the innovative approaches taken by these companies to provide comprehensive health cover at affordable rates and analyze the long-term benefits and ROI experienced by them.

Case Study 1: XYZ Company

- XYZ Company, a small business with 50 employees, decided to offer affordable private health cover options to attract and retain top talent.

- By partnering with a local health insurance provider, they were able to negotiate discounted rates for their employees, making the health cover more affordable.

- As a result, XYZ Company saw a decrease in employee turnover and an increase in overall job satisfaction among their staff.

Success Story 1: ABC Inc.

- ABC Inc., a small tech startup, implemented a wellness program in addition to private health cover options for their employees.

- By promoting a healthy lifestyle and preventative care, they were able to reduce healthcare costs and improve employee productivity.

- This innovative approach not only saved money for ABC Inc. but also boosted employee morale and loyalty.

ROI Analysis

- Small companies that invest in affordable private health cover options for their employees often see a positive return on investment in the long run.

- Lower healthcare costs, reduced absenteeism, and increased employee productivity are some of the key factors contributing to this positive ROI.

- By prioritizing employee health and well-being, small companies can create a more engaged and loyal workforce, leading to greater business success.

Employee Satisfaction and Retention Rates

- Small companies offering affordable private health cover options tend to have higher employee satisfaction and retention rates compared to those that do not provide such benefits.

- Employees feel valued and taken care of when their employer offers comprehensive health cover, leading to increased loyalty and commitment to the company.

- By prioritizing the health and wellness of their employees, small companies can create a positive work environment and attract top talent in the competitive job market.

Ultimate Conclusion

In conclusion, the journey through the realm of Affordable Private Health Cover Options for Small Companies sheds light on the significance of offering competitive benefits packages to enhance employee satisfaction and retention, ultimately contributing to the overall success of small businesses.

Detailed FAQs

What factors contribute to making private health cover affordable for small companies?

Factors such as group discounts, tailored plans for small businesses, and cost-sharing strategies play a significant role in making private health cover affordable for small companies.

How can small companies negotiate affordable private health cover plans with insurance providers?

Small companies can negotiate by exploring different plan options, leveraging group rates, and highlighting the value of long-term partnerships with insurance providers.

What are the pros and cons of offering health savings accounts (HSAs) as private health cover options for small companies?

HSAs offer tax advantages and flexibility in healthcare spending but require employees to manage their own funds and may not be suitable for those with high medical expenses.