Delving into the realm of Business General Liability Insurance in 2025, this introduction sets the stage for an enlightening exploration of the evolving landscape of insurance. With a focus on cutting-edge trends and technological advancements, readers are in for a thought-provoking journey into the world of business insurance.

Providing insights into the changing dynamics of coverage options, risk assessment strategies, and regulatory compliance, this discussion aims to equip readers with the knowledge needed to navigate the intricacies of insurance in the upcoming year.

Introduction to Business General Liability Insurance in 2025

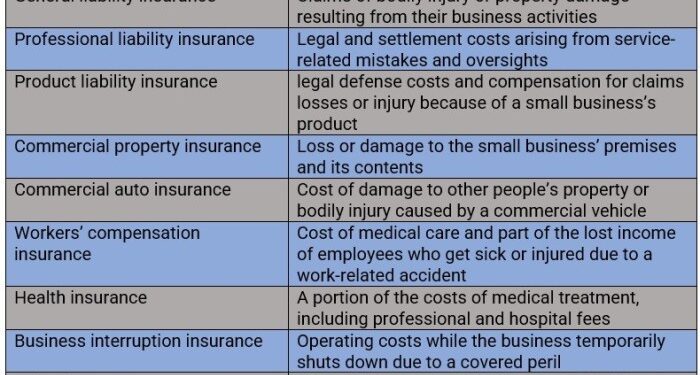

Business general liability insurance serves as a crucial safety net for companies, protecting them from financial losses due to claims of bodily injury, property damage, and other liabilities. It helps businesses cover legal costs and settlements, ensuring their financial stability in the face of unexpected events.

Staying up-to-date with insurance trends is essential for businesses to ensure they have adequate coverage tailored to their specific needs. As the business landscape evolves, new risks emerge, making it crucial for companies to regularly review and adjust their insurance policies to safeguard their operations effectively.

Advancements in Technology and the Insurance Industry

Technological advancements are reshaping the insurance industry, offering new opportunities for improved efficiency and customer service. The use of data analytics, artificial intelligence, and automation is streamlining insurance processes, from underwriting to claims management, enhancing the overall customer experience.

Changes in Coverage and Policies

In the ever-evolving landscape of business general liability insurance, it is crucial to stay informed about the changes in coverage options and policies that may impact your business. Let's explore how the coverage landscape is shifting and what new solutions are emerging to meet the needs of businesses in 2025.

Evolving Coverage Options

- Traditional policies typically offer coverage for bodily injury, property damage, and advertising injury. However, newer policies may include cyber liability, reputational harm, and business interruption coverage to address modern risks.

- Insurance carriers are increasingly offering customizable policies that allow businesses to tailor coverage to their specific needs. This flexibility ensures that businesses are adequately protected against a wide range of risks.

- Emerging trends such as climate change, pandemics, and supply chain disruptions are influencing the coverage options available in business general liability insurance. Insurers are adapting to provide coverage for these evolving risks.

Specific Industries Affected

- Technology companies may require specialized coverage for data breaches and intellectual property infringement, reflecting the unique risks they face in the digital age.

- Healthcare providers may see changes in coverage requirements to address medical malpractice claims and regulatory compliance in an increasingly complex healthcare environment.

- Construction companies could benefit from policies that cover environmental liabilities and subcontractor risks, considering the hazardous nature of their work.

Technology and Risk Assessment

In today's rapidly evolving business landscape, technology plays a crucial role in shaping risk assessment within the insurance sector. With the advent of AI and data analytics, insurers are now able to leverage advanced tools to accurately evaluate and predict potential risks for businesses.

Role of AI and Data Analytics in Risk Assessment

- AI algorithms can analyze vast amounts of data to identify patterns and trends, helping insurers assess risks more effectively.

- Data analytics enables insurers to make data-driven decisions, leading to more accurate risk assessments and tailored insurance policies.

- Real-time monitoring through technology allows insurers to respond promptly to emerging risks and provide proactive solutions to policyholders.

Cyber Liability Coverage for Digital Threats

- Cyber liability coverage has become increasingly important as businesses face a rising number of cyber threats and data breaches.

- This type of insurance helps businesses mitigate financial losses and reputational damage resulting from cyber attacks.

- Insurers leverage technology to assess cyber risks, offer customized coverage, and provide support in the event of a cyber incident.

Leveraging Technology to Minimize Risks

- Businesses can implement cybersecurity measures and utilize risk assessment tools to identify vulnerabilities and strengthen their defense against cyber threats.

- By investing in technology solutions such as firewalls, encryption, and employee training, businesses can reduce the likelihood of cyber attacks and potential financial losses.

- Insurers may offer discounts on insurance premiums to businesses that demonstrate proactive risk management through technology adoption and compliance with cybersecurity best practices.

Impact of Global Events on Insurance Trends

Global events such as pandemics and natural disasters have a significant impact on insurance trends, especially in the realm of business general liability insurance. These events can lead to increased risks and uncertainties for businesses, making it crucial for companies to have comprehensive coverage to mitigate unforeseen challenges.

Adapting Coverage for Global Uncertainties

- Business Interruption Insurance: With the rise of global events disrupting operations, businesses may consider adding business interruption insurance to their policies. This coverage can help companies recover financial losses incurred due to forced closures or disruptions.

- Pandemic Coverage: In light of recent global pandemics, businesses are now looking into specific pandemic coverage options to protect themselves from the financial impacts of widespread health crises. This add-on can provide coverage for expenses related to outbreaks, closures, and other pandemic-related issues.

- Supply Chain Coverage: Global events can disrupt supply chains, affecting businesses' ability to operate smoothly. Businesses may opt for supply chain coverage to protect themselves from financial losses due to interruptions in the supply chain caused by global events.

Risk Management Strategies for Global Events

- Scenario Planning: Businesses can engage in scenario planning to anticipate and prepare for potential global events that could impact their operations. By developing contingency plans, businesses can better manage risks and minimize the impact of unforeseen events.

- Regular Review of Policies: Given the evolving nature of global events, it is essential for businesses to regularly review their insurance policies to ensure they have adequate coverage. This proactive approach can help businesses stay prepared for any unexpected events.

- Collaboration with Insurers: Businesses can work closely with insurers to assess their risks and tailor insurance policies to address specific global event scenarios. By collaborating with insurers, businesses can better understand their coverage options and make informed decisions to protect their operations.

Regulatory Changes and Compliance

In the dynamic landscape of business general liability insurance, regulatory changes play a significant role in shaping the insurance environment. It is crucial for businesses to stay compliant with these regulations to avoid potential legal consequences and ensure they have adequate coverage to protect their operations.

Upcoming Regulatory Changes

As we look into 2025, there are several upcoming regulatory changes that could impact business general liability insurance. For example, new laws or amendments may be introduced to address emerging risks such as cybersecurity threats or climate change-related damages. These changes could affect the coverage requirements, premiums, and overall risk assessment for businesses.

- Increased focus on cybersecurity: With the rise of cyber threats, regulatory bodies may enforce stricter requirements for businesses to protect sensitive data. This could lead to changes in liability insurance policies to cover cyber-related risks.

- Environmental regulations: As climate change becomes a growing concern, businesses may need to comply with new environmental regulations. This could result in adjustments to liability insurance to address potential environmental damages or pollution incidents.

Adapting to Regulatory Changes

Businesses can adapt to regulatory changes by staying informed about the latest developments in insurance regulations and seeking guidance from insurance professionals. It is essential for businesses to review their insurance policies regularly and make any necessary adjustments to ensure they are compliant with the updated regulations.

By proactively monitoring regulatory changes and maintaining compliance, businesses can avoid potential gaps in coverage and mitigate risks effectively.

Final Conclusion

In conclusion, A Breakdown of Business General Liability Insurance in 2025 offers a comprehensive overview of the key factors shaping the future of insurance. By embracing innovation, staying informed about industry trends, and ensuring regulatory compliance, businesses can proactively safeguard their interests and thrive in an ever-evolving insurance landscape.

FAQ Overview

What are the emerging trends in business general liability insurance for 2025?

Emerging trends include a shift towards more tailored insurance solutions, increased reliance on technology for risk assessment, and a greater emphasis on cyber liability coverage.

How can businesses adapt to regulatory changes affecting general liability insurance?

Businesses can adapt by staying informed about upcoming regulatory changes, ensuring compliance with insurance regulations, and reviewing their coverage to align with new requirements.

Which industries are likely to see significant changes in coverage requirements in 2025?

Industries such as healthcare, technology, and finance may see significant changes in coverage requirements due to evolving risks and regulatory developments.