Delve into the world of Progressive Commercial Auto Insurance for Entrepreneurs where tailored coverage meets the unique needs of business owners. This guide offers insights, comparisons, and success stories to shed light on the benefits of choosing Progressive.

Overview of Progressive Commercial Auto Insurance

Progressive Commercial Auto Insurance offers a range of coverage options tailored specifically for entrepreneurs and small business owners who rely on vehicles for their operations. Whether you have a single vehicle or a fleet, Progressive provides customizable policies to meet your unique needs.

Key Features of Progressive Commercial Auto Insurance

- Flexible coverage options to protect your business vehicles and drivers

- 24/7 claims service to ensure quick resolution in case of accidents or damage

- Competitive rates and discounts for safe driving records and multiple policies

- Access to tools and resources to help you manage your policy online efficiently

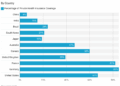

Comparison with Other Commercial Auto Insurance Providers

Progressive stands out from other commercial auto insurance providers due to its focus on innovation, customer service, and competitive pricing. While other companies may offer similar coverage options, Progressive's dedication to providing tailored solutions for entrepreneurs sets it apart in the industry.

Benefits of Progressive Commercial Auto Insurance for Entrepreneurs

When it comes to running a business, having the right insurance coverage is crucial. Progressive Commercial Auto Insurance offers a range of benefits specifically tailored to meet the needs of entrepreneurs. From protecting your vehicles to providing financial security, Progressive has you covered.

Comprehensive Coverage Options

- Progressive offers a variety of coverage options, including liability, collision, and comprehensive coverage, to protect your vehicles in case of accidents or damages.

- The flexibility to customize your policy allows you to add specific coverages based on your business needs, ensuring you have the right protection in place.

Affordable Premiums

- Progressive offers competitive rates for commercial auto insurance, helping entrepreneurs save money while still getting the coverage they need.

- Discounts are available for safe driving records, bundled policies, and more, making it cost-effective to insure your business vehicles with Progressive.

24/7 Customer Support

- Progressive provides around-the-clock customer support, so you can get assistance whenever you need it, whether it's filing a claim or updating your policy.

- Their responsive claims service ensures a quick and hassle-free process, allowing you to get back on the road and focus on growing your business.

Success Stories

"Since switching to Progressive Commercial Auto Insurance, I've had peace of mind knowing that my business vehicles are protected. Their affordable rates and excellent customer service have made a significant difference in managing my operations."

John, Small Business Owner

"Progressive's comprehensive coverage options have saved me from costly repairs and liabilities. Their dedicated support team has been a true partner in helping me navigate insurance matters for my growing business."

Sarah, Entrepreneur

Customized Coverage Options

When it comes to entrepreneurs, Progressive Commercial Auto Insurance offers a range of customized coverage options to meet their unique needs and protect their business assets on the road.

Specialized Coverage for Business Vehicles

- Progressive provides coverage for multiple types of vehicles used for business purposes, such as delivery vans, trucks, or company cars.

- Entrepreneurs can add specialized coverage options like hired auto coverage or non-owned auto coverage to protect vehicles not owned by the business but used for work.

- Customizable coverage limits and deductibles allow entrepreneurs to tailor their policy to fit their specific requirements.

General Liability Coverage

- Progressive offers general liability coverage as part of its commercial auto insurance policies, providing protection against third-party claims for bodily injury or property damage.

- This coverage can be essential for entrepreneurs who interact with clients, customers, or other businesses while on the road.

Enhanced Coverage Options

- Entrepreneurs can opt for additional coverage options such as roadside assistance, rental reimbursement, or gap coverage to ensure comprehensive protection for their business vehicles.

- Progressive's customizable policies allow entrepreneurs to add endorsements or riders to their coverage, addressing specific risks or needs that may arise in their line of work.

Cost and Savings

When it comes to the cost structure of Progressive Commercial Auto Insurance for entrepreneurs, it is important to understand that the premium you pay will depend on various factors such as the type of coverage, the number of vehicles insured, the driving history of the drivers, and the deductible chosen

Progressive offers competitive rates tailored to meet the specific needs of entrepreneurs.

Breakdown of Cost Structure

- Base premium: This is the standard cost of the insurance policy before any discounts or additional coverage options are added.

- Additional coverage: Entrepreneurs can choose to add on extra coverage options such as roadside assistance, rental reimbursement, or comprehensive coverage, which will impact the overall cost.

- Deductible: The amount you agree to pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your premium but will require you to pay more in the event of a claim.

- Discounts: Progressive offers various discounts for entrepreneurs, such as multi-policy discounts, safety discounts, and telematics discounts based on driving behavior.

How Entrepreneurs Can Save Money

Entrepreneurs can save money on their commercial auto insurance with Progressive by:

- Bundle policies: Combining commercial auto insurance with other insurance policies like general liability or business owners' policy can result in significant savings.

- Safe driving: Encouraging safe driving practices among employees can lead to lower premiums through safe driver discounts.

- Regular policy review: Periodically reviewing your policy with a Progressive agent can help identify potential savings opportunities or coverage adjustments based on your evolving business needs.

Tips for Maximizing Savings

- Compare quotes: Getting quotes from multiple insurance providers, including Progressive, can help you find the best rates for your commercial auto insurance.

- Opt for higher deductibles: Choosing a higher deductible can lower your premium, but make sure you can afford the out-of-pocket expense in case of a claim.

- Utilize available discounts: Take advantage of all applicable discounts offered by Progressive to maximize your savings on commercial auto insurance.

Claims Process and Customer Support

When it comes to insurance, a smooth claims process and reliable customer support are crucial for entrepreneurs. Progressive Commercial Auto Insurance understands the needs of business owners and offers a streamlined claims process along with excellent customer support to ensure a hassle-free experience in case of any unfortunate incidents.

Progressive's Claims Process

- Progressive offers a user-friendly online claims portal where entrepreneurs can easily report any incidents and track the progress of their claims.

- Entrepreneurs can also file claims over the phone with Progressive's dedicated claims representatives who provide assistance throughout the process.

- Progressive aims to settle claims quickly and efficiently, minimizing downtime for entrepreneurs and helping them get back on the road as soon as possible.

Customer Support Comparison

- Progressive's customer support is known for being responsive, knowledgeable, and helpful, providing entrepreneurs with the assistance they need when filing claims or addressing any policy-related queries.

- Compared to other insurance providers, Progressive's customer support stands out for its personalized approach and commitment to ensuring customer satisfaction.

- Entrepreneurs can rely on Progressive's customer support team to guide them through the claims process, clarify any doubts, and provide prompt resolutions to their concerns.

Best Practices for Navigating Claims Process

- Report incidents promptly to Progressive to initiate the claims process without delays.

- Document all relevant details, including photos and witness statements, to support your claim and expedite the assessment process.

- Stay in communication with Progressive's claims representatives and follow up on the progress of your claim to ensure a timely resolution.

Final Conclusion

In conclusion, Progressive Commercial Auto Insurance stands out as a reliable choice for entrepreneurs seeking customized coverage and cost-effective solutions. With a focus on customer support and claims process efficiency, Progressive aims to provide peace of mind to entrepreneurial drivers.

FAQs

How does Progressive tailor its coverage for entrepreneurs?

Progressive offers customized coverage options that cater to the specific needs of entrepreneurs, providing flexibility and comprehensive protection.

Can entrepreneurs save money with Progressive Commercial Auto Insurance?

Entrepreneurs can benefit from cost savings with Progressive through competitive pricing and various discounts tailored for business owners.

What sets Progressive's customer support apart from other providers?

Progressive's customer support is known for its efficiency and responsiveness, ensuring entrepreneurs receive timely assistance throughout the claims process.