As Top Factors That Affect Your Homeowners Insurance Quote takes center stage, this opening passage beckons readers with engaging insights into the key elements influencing insurance quotes. From location to personal credit score, each factor plays a crucial role in determining the cost of homeowners insurance.

Let's delve into the intricate web of components that shape your insurance quotes.

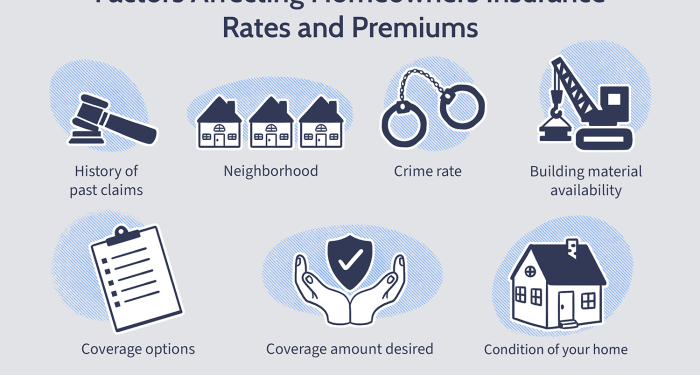

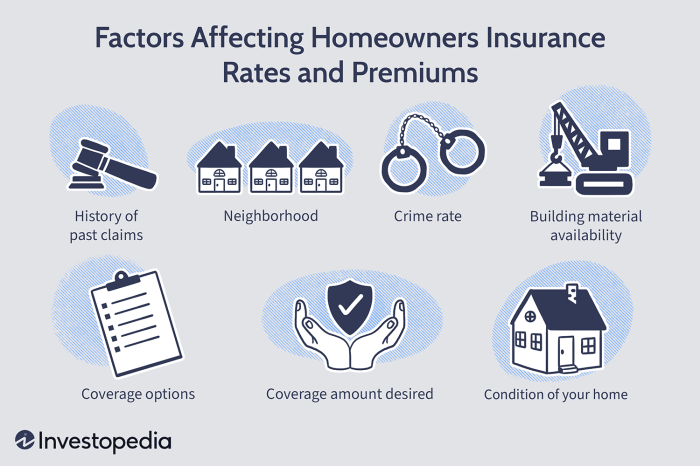

Factors Influencing Homeowners Insurance Quote

Location plays a crucial role in determining homeowners insurance quotes. Areas prone to natural disasters or high crime rates typically have higher insurance costs due to increased risk.

Impact of Location on Insurance Quotes

Insurance companies consider the location of a home when calculating insurance quotes. Homes located in regions prone to natural disasters like hurricanes, earthquakes, or floods usually have higher premiums. Similarly, homes in areas with high crime rates may also face increased insurance costs due to the higher risk of theft or vandalism.

Effect of Age and Condition of Home on Insurance Costs

The age and condition of a home can significantly impact insurance costs. Older homes may require more maintenance and repairs, making them riskier to insure. Homes in poor condition or with outdated systems may be more susceptible to damage, leading to higher premiums.

Significance of Coverage Amount on Insurance Quotes

The coverage amount chosen by homeowners directly affects insurance quotes. Opting for higher coverage limits will result in higher premiums, as the insurance company is taking on more risk by providing greater coverage. It is essential for homeowners to balance coverage needs with budget constraints to find the right insurance policy.

Impact of Home Characteristics

When it comes to determining homeowners insurance quotes, various home characteristics play a significant role. Factors such as roofing material, safety features, and the size of the home can all impact the cost of insurance premiums.

Type of Roofing Material

The type of roofing material used on a home can have a direct impact on insurance premiums. Homes with durable and fire-resistant roofing materials, such as metal or tile, may qualify for lower insurance rates due to the reduced risk of damage from fire or severe weather events.

On the other hand, homes with more fragile roofing materials, like wood shingles, may face higher insurance costs due to the increased risk of damage.

Safety Features like Smoke Detectors

Installing safety features like smoke detectors can also play a role in lowering insurance costs. Homes equipped with smoke detectors, carbon monoxide detectors, burglar alarms, and other security systems are considered lower risk by insurance companies. As a result, homeowners with these safety features in place may be eligible for discounts on their insurance premiums.

Size of the Home

The size of a home can influence insurance quotes as well. Larger homes typically have higher replacement costs, which can lead to higher insurance premiums. Additionally, larger homes may also be seen as higher risk due to the increased likelihood of expensive claims in the event of damage or loss.

Conversely, smaller homes may be eligible for lower insurance rates due to their lower replacement costs and perceived lower risk.

Personal Factors

When it comes to determining homeowners insurance rates, personal factors play a significant role. Let's explore how these factors can impact your insurance premiums.

Credit Score

Your credit score can have a direct impact on the homeowners insurance rates you are quoted. Insurance companies often use credit-based insurance scores to assess the risk of insuring a particular individual. A higher credit score is typically associated with lower risk, leading to lower insurance premiums.

On the other hand, a lower credit score may result in higher insurance rates.

Swimming Pool

The presence of a swimming pool on your property can also affect your homeowners insurance premiums. Swimming pools are considered attractive nuisances, as they pose potential safety risks. This increases the liability exposure for the insurance company, leading to higher premiums.

In some cases, you may be required to install safety features such as fences or covers to mitigate these risks.

Past Insurance Claims

The frequency of past insurance claims can impact the quotes you receive for homeowners insurance

On the other hand, policyholders with a clean claims history may be eligible for lower insurance rates.

External Factors

Crime rate in the neighborhood, proximity to natural disaster-prone areas, and local building costs and labor rates are external factors that can significantly impact your homeowners insurance quote.

Crime Rate Influence

The crime rate in your neighborhood plays a crucial role in determining your insurance prices. Higher crime rates often lead to increased risk of theft, vandalism, or property damage, which can result in higher insurance premiums. Insurance companies consider the likelihood of these incidents when calculating your quote.

- Areas with lower crime rates generally have lower insurance costs.

- Installing security systems and taking preventive measures can help lower insurance premiums.

- Insurance companies may offer discounts for homes in safer neighborhoods.

Proximity to Natural Disaster-Prone Areas

Living in an area prone to natural disasters such as hurricanes, earthquakes, or wildfires can also impact your insurance costs. Properties located in high-risk areas are more susceptible to damage, leading to higher insurance premiums to account for the increased risk of potential claims.

- Homes in flood zones or earthquake-prone regions typically have higher insurance rates.

- Investing in disaster-resistant home improvements can help mitigate insurance costs.

- Insurance companies may require additional coverage for specific natural disasters.

Local Building Costs and Labor Rates

The local building costs and labor rates in your area can influence your homeowners insurance quote. Higher construction costs and labor rates mean that repairs or rebuilding your home in the event of damage will be more expensive, leading to higher insurance premiums to cover these potential expenses.

- Areas with rising construction costs may see an increase in insurance quotes.

- Home renovation or improvements can impact insurance rates based on the increased value of the property.

- Insurance companies consider local pricing when determining coverage limits and premiums.

Final Thoughts

In conclusion, understanding the top factors that affect your homeowners insurance quote is essential in making informed decisions about your coverage. By considering aspects like home characteristics, personal factors, and external influences, you can navigate the insurance landscape with confidence.

Your insurance quote is a reflection of these factors, so being aware of them can help you secure the best possible coverage at the right price.

Q&A

How does the type of roofing material impact insurance premiums?

The type of roofing material can affect insurance premiums as certain materials may be more prone to damage or require more expensive repairs.

How does the presence of a swimming pool impact insurance premiums?

Having a swimming pool can increase insurance premiums due to the potential liability risks associated with pools.

How does the crime rate in the neighborhood influence insurance prices?

A higher crime rate in the neighborhood can lead to increased insurance prices as the risk of theft or vandalism is higher.

How does proximity to natural disaster-prone areas affect insurance costs?

Living in areas prone to natural disasters can result in higher insurance costs due to the increased risk of property damage.

How do local building costs and labor rates impact insurance quotes?

Higher local building costs and labor rates can contribute to higher insurance quotes as the cost of repairs or rebuilding may be more expensive.